BIG SKY RESORT AREA DISTRICT

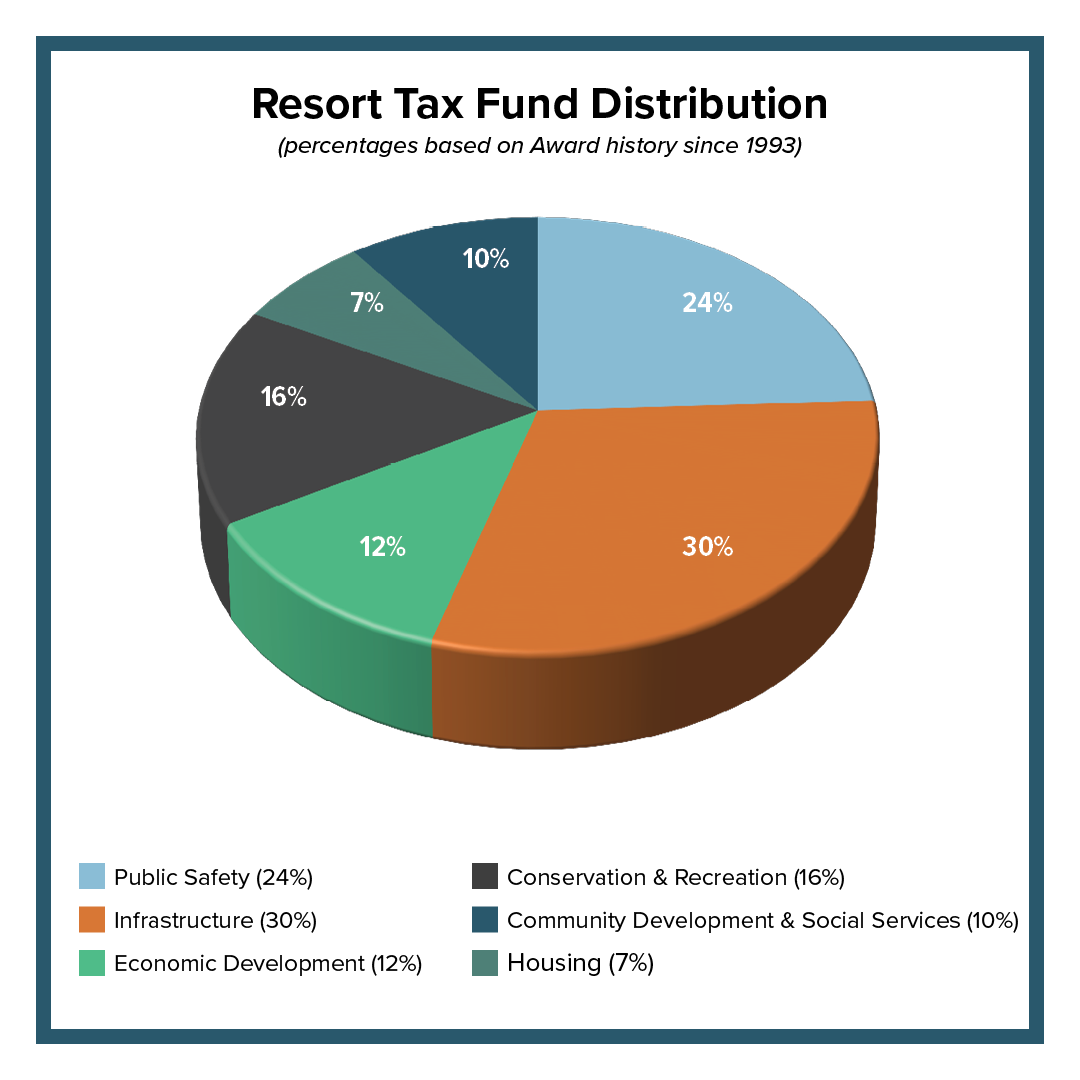

Resort Tax

HOW MUCH?

4%*

$7,671,899 collected in 2020

* 1% is committed for Infrastructure, and currently funding community water & sewer upgrades

WHO PAYS?

Those purchasing luxury goods and services sold in the District.

WHO COLLECTS?

Local businesses collect and remit (not pay), retaining 5% for administrative processing.

WHERE DOES IT GO?

100% to Big Sky

FUNDS AWARDED SINCE 1993: $73,179,009

STATE OF MONTANA

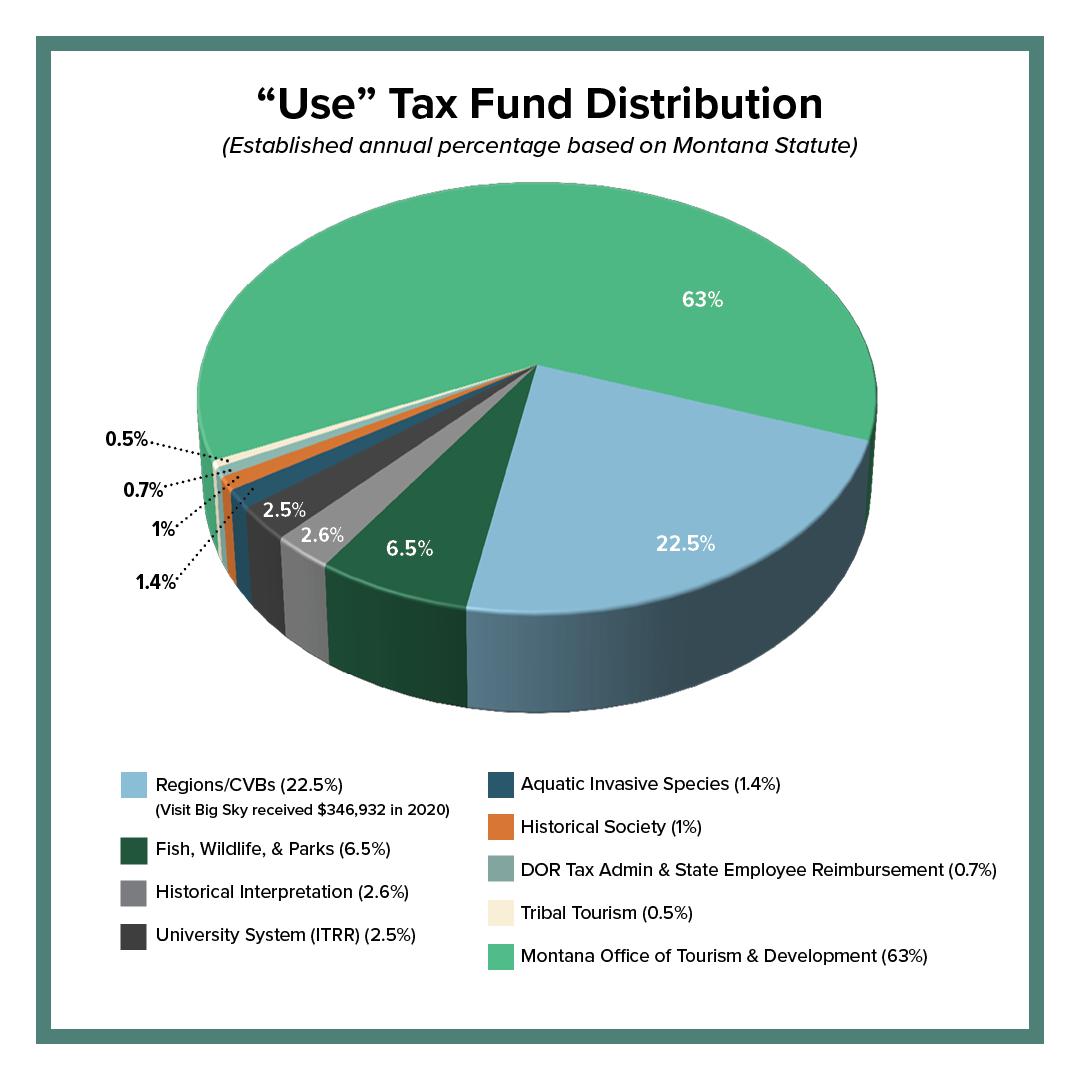

Lodging Facility Sales & Use Tax

HOW MUCH?

8%

$61,531,300* collected in 2020

• 4% “Use” Tax: $33,734,000

• 4% “Sales” Tax: $25,058,000

*$6,633,807 collected in the Big Sky Resort Area District in 2020, surpassing Billings as the largest Lodging Tax collector in the state.

WHO PAYS?

Those purchasing short-term lodging (hotels, motels, campgrounds, vacation rentals, dude ranches, etc.) in Montana.

WHO COLLECTS?

Lodging establishments

WHERE DOES IT GO?

“USE” TAX: See chart

“SALES” TAX: 75% towards the State General Fund, and, until 2025, 25% towards the construction of the Montana Heritage Center and historic preservation grants.

GALLATIN & MADISON COUNTIES

Property Tax

HOW MUCH?

% variable based on tax formula

• Madison County: $46,537,891 collected in 2020

• $31,740,720 collected from Big Sky

• Gallatin County: $187,502,399

• $14,106,771 collected from Big Sky

WHO PAYS?

Property owners, including landowners, homeowners, and business owners.

WHO COLLECTS?

Gallatin & Madison Counties

WHERE DOES IT GO?

Property taxes fund all governmental levels (State, County, and Local). The County Treasurer collects Property Taxes in November and May. They then distribute funds to each entity based on the mills that entity has levied.

STATE: General Fund (Including State Schools and Universities)

COUNTY: Infrastructure, health & human services, public safety, county administration, and more

LOCAL: Depends upon voter-approved mills and location of property.